What Most Businessmen Get Wrong About Wealth, Wills, and What Really Matters

Introduction: The Real Cost of Dying Rich and Unprepared

You’ve worked hard. You’ve built the business, secured the bag, and accumulated wealth that most only dream of.

But here’s the uncomfortable truth:

Your success won’t matter if your death creates a mess.

Too many high-income entrepreneurs and married businessmen confuse making money with protecting it. And they assume a simple will—or worse, verbal intentions—are enough to take care of their legacy.

They’re wrong.

This article is a wake-up call. We’ll unpack the most common mistakes successful men make with wealth, wills, and what truly matters—and give you the tools to protect your family, your business, and your peace of mind.

What Most Businessmen Get Wrong About Wealth, Wills, and What Really Matters.

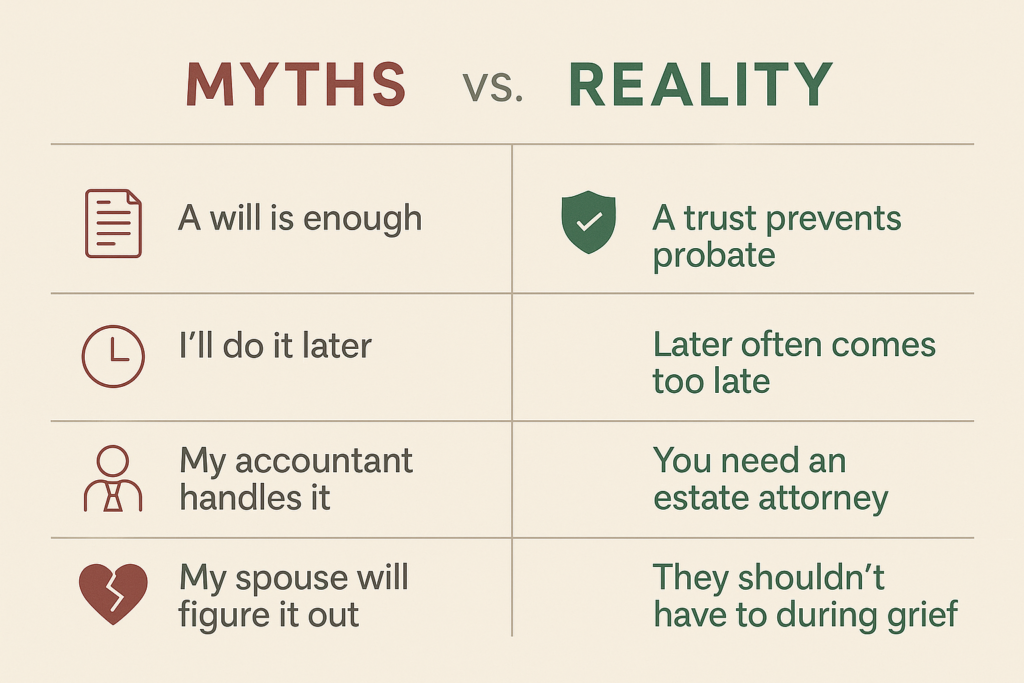

The Myths That Leave Businessmen Exposed

You’re not careless—you’re just busy. And the myths around legacy planning are easy to believe, especially when everything seems to be going well.

Common (Dangerous) Myths:

- “I’ll do it later.”

Life is unpredictable. And “later” often comes too late. - “My accountant handles this.”

CPAs optimize taxes. Estate attorneys protect everything else. - “I’m not rich enough for all that.”

If you have a business, property, kids—or all three—you need a plan. - “My spouse will figure it out.”

Leaving them to make complex legal and financial decisions while grieving is unfair and avoidable.

Table contrasting Myths vs. Reality

The Real Definition of Wealth (Hint: It’s Not Just Money)

Wealth isn’t just what you leave—it’s how you live.

As a high-performing businessman, your wealth includes:

- Financial assets

- Businesses and investments

- Intellectual property

- Family values, relationships, and leadership

The Shift:

From “What will I leave behind?”

To “What am I living into—and who will carry it forward?”

“Your children won’t inherit your hustle. They’ll inherit your systems, your scars, and your standards.” – Anonymous Family Office Strategist

The 3-Part Framework for a Legacy That Lasts

Legacy isn’t accidental. It’s engineered.

1. Clarity

Ask:

- What do I want my wealth to do for my family?

- What legacy lessons do I want to pass down?

- What values matter more than money?

This is the foundation of your plan.

2. Structure

This is where most entrepreneurs fall short. You need more than a will.

Essential tools:

- Living trust (avoids probate)

- Healthcare and financial powers of attorney

- Buy-sell agreement for business partners

- Life insurance for tax-free wealth transfer

- Succession plan with clear leadership roadmap

These aren’t just legal docs. They’re shields that protect your life’s work.

3. Communication

The best legacy plan in the world is useless if your family is shocked by it.

- Involve your spouse early and often

- Have yearly “legacy reviews” with your family or advisor

- Write a “legacy letter” explaining the heart behind your decisions

What Most Businessmen Forget to Protect

- Their spouse: Left without access, clarity, or confidence

- Their children: Handed money without mentorship

- Their business: Disrupted by probate, legal battles, or lack of a succession plan

- Their values: Never documented, never passed down

Real Cost Example:

John died with a $15M company… and no succession plan. His wife spent two years in probate, the business lost its largest client, and his two sons haven’t spoken since the fallout.

Success Stories: When Legacy Is Done Right

- Carlos & Elena created a legacy trust, business continuity plan, and hosted a family vision summit each year. Their children now run the business with pride, clarity, and unity.

- Damon, a 7-figure entrepreneur, said:

“Applying for legacy planning coaching was the smartest thing I’ve done since launching my business. My wife sleeps better. So do I.”

Conclusion: You’re Not Just Building a Business. You’re Building a Legacy.

If your estate plan is half-finished—or nonexistent—your success is at risk.

Your family deserves more than your income. They deserve your intention.

You already built the wealth. Now build the wisdom to protect it.

Call to Action: Protect What Matters Most

👉 Apply for a Legacy Planning Consultation

👉 Hire a Generational Wealth Advisor

👉 Schedule Your Family Wealth Strategy Session

👉 Register for the Estate Planning Workshop for Entrepreneurs

Because it’s not just about what you leave behind—it’s about what they’ll carry forward.

🔥 Ready to Step Into the Room That Changes Everything?

You weren’t meant to lead alone. You weren’t made to carry the weight in silence.

There’s a reason you’re still searching—even with the success you’ve built.

This isn’t a seminar. It’s a mirror. A reset. A brotherhood.

Join 100 high-performing men—fathers, husbands, leaders—who are ready to trade surface-level success for deep-rooted significance.

At this event, you won’t just learn—you’ll confront, clarify, and come back home different.

📍 Laguna Beach | June 2025

2 Days. One Room. Zero Masks.

👉 Apply Now — Spots are limited and reserved for men ready to face the truth.

👉 Watch the Event Preview to see what’s waiting on the other side.

“Don’t wait for rock bottom. Draw the line. Get in the room.”