If Your Finances Stress You Out, You’re Not Rich—You’re Just Exhausted

Introduction: More Money, More Pressure?

If you’re searching for financial stress relief for entrepreneurs, you’re not alone. You’ve built the income—but not the peace.

So why do your finances still feel like a weight on your chest?

If you’re honest, money isn’t freedom—it’s a source of pressure. The numbers look good… but something’s off. You’re constantly checking accounts, double-guessing decisions, and lying awake at night thinking, “Am I really okay?”

Here’s the truth:

If your finances are stressing you out, you’re not rich. You’re just exhausted.

If you’re looking for real financial stress relief for entrepreneurs, this isn’t about budgeting apps—it’s about mental margin.

In this article, we’ll expose the real reason behind high-income financial burnout, provide a new definition of wealth, and show you how to build a financial strategy that creates peace—not pressure.

Summary: Rich is when money buys freedom—not when it becomes your silent prison.

The Hidden Burnout of High-Income Earners

Success brings complexity. More revenue doesn’t just mean more freedom—it often means more moving parts, more responsibility, and more emotional strain if you don’t have a system.

Signs You’re Financially Exhausted (Even If You’re Earning Big)

- You’re scared to look at your own numbers

- You’re the only one making financial decisions—for both home and business

- Your spouse seems stressed about money, but neither of you wants to bring it up

- You make a lot… but somehow you still feel like you’re behind

According to a U.S. Bank study, 48% of high-income business owners feel “somewhat” or “very” out of control with their finances—not because of lack, but lack of clarity.

Even high earners face hidden financial stress—these are the top culprits.

Wealth Without Margin Isn’t Wealth—It’s a Trap

So many entrepreneurs confuse income with wealth. They chase bigger top-line revenue but never feel secure, free, or fulfilled.

Why Margin Matters More Than Money

- Emotional margin: You’re not panicked when a surprise bill hits

- Mental margin: You’re not constantly making reactive decisions

- Relational margin: You’re not short-tempered because of silent stress

“Being rich means nothing if your brain is fried and your family feels forgotten.” – Coach Sam Falsafi

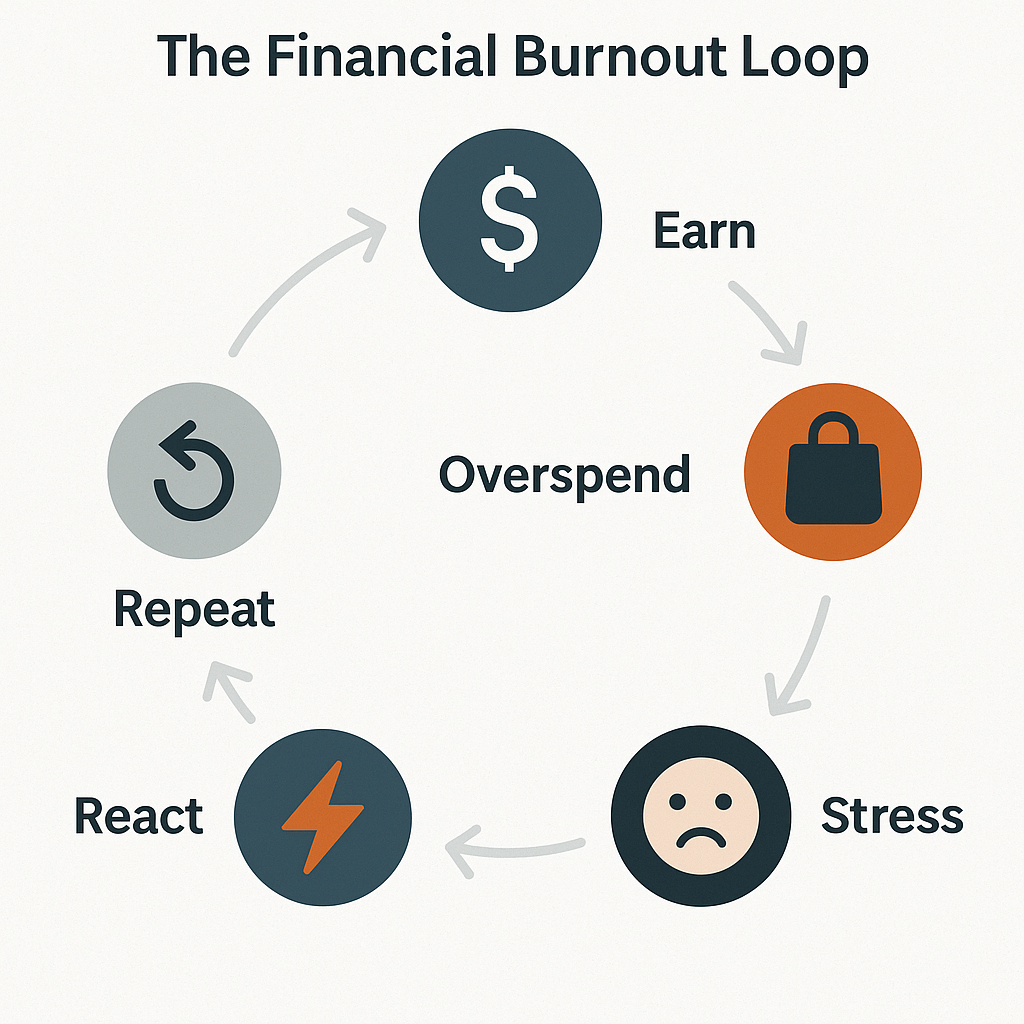

What’s Really Causing the Stress? It’s Not the Money

Let’s be clear: income isn’t the problem. But lack of clarity, control, and intentionality is.

Common Financial Stress Triggers

- No unified financial system (business and personal are in silos)

- Reactive cash flow (decision-making based on panic, not planning)

- Lifestyle creep without strategy

- No backup brain—no CFO, no coach, no roadmap

The Financial Burnout Loop”: Earn → Overspend → Stress → React → Repeat

The Framework: From Financial Stress to Strategic Wealth

Let’s look at what real financial stress relief for entrepreneurs looks like in practical terms—because margin, not money, is what makes wealth sustainable.

🧠 Step 1: Install Clarity

- Use a unified dashboard (e.g., personal + business together)

- Categorize monthly into: Fixed Costs, Freedom Fund, Growth Capital

- Work with a personal CFO or wealth strategist

💸 Step 2: Separate Cash from Confidence

- Stop tying identity to income

- Set “enough” floors, not just “more” targets

- Automate profits: Profit First, automatic transfers, etc.

📅 Step 3: Align Goals with Energy

- Ask: “Is this financial path costing me more than it creates?”

- Audit revenue by effort-to-margin ratio

- Build for peace, not ego

📄 Downloadable PDF: “10-Point Financial Clarity Checklist for Business Dads”

Bring the Family In—They’re Already Feeling It

Your financial stress doesn’t stay in QuickBooks. It walks into your home with you.

How to Reclaim Peace at Home

- Have one aligned wealth conversation monthly with your spouse

- Create a 10-year family wealth vision together (investments, goals, philanthropy)

- Let your kids see what smart, stress-free stewardship looks like

“You can’t say your family is your ‘why’ if your finances are driving a wedge between you.”

Quick Wins to Start Feeling Rich (Without Earning More)

- ✅ 30-minute Weekly Wealth Review (Friday is ideal)

- ✅ Automate 10–15% into wealth-building buckets (cash, investment, margin)

- ✅ Hire a bookkeeper or CFO if you dread numbers

- ✅ Share your 3 biggest financial fears with a mentor or coach

Margin vs Income

Conclusion: Wealth Isn’t the Goal. Peace Is.

If your money is stressing you out, it’s not working for you—it’s owning you.

You didn’t build this business to be in a constant state of tension and reactivity.

Real wealth is margin, clarity, and control—and you can start building that today, without earning more.

👉 Join the Syndicate Council Summit and learn how to turn income into peace, profit into presence, and pressure into purpose.

Because a man with peace is always richer than a man with pressure.

Downloadable PDF: “10-Point Financial Clarity Checklist for Business Dads”

🔥 Ready to Step Into the Room That Changes Everything?

You weren’t meant to lead alone. You weren’t made to carry the weight in silence.

There’s a reason you’re still searching—even with the success you’ve built.

This isn’t a seminar. It’s a mirror. A reset. A brotherhood.

Join 100 high-performing men—fathers, husbands, leaders—who are ready to trade surface-level success for deep-rooted significance.

At this event, you won’t just learn—you’ll confront, clarify, and come back home different.

📍 Laguna Beach | June 2025

2 Days. One Room. Zero Masks.

👉 Apply Now — Spots are limited and reserved for men ready to face the truth.

👉 Watch the Event Preview to see what’s waiting on the other side.

“Don’t wait for rock bottom. Draw the line. Get in the room.”